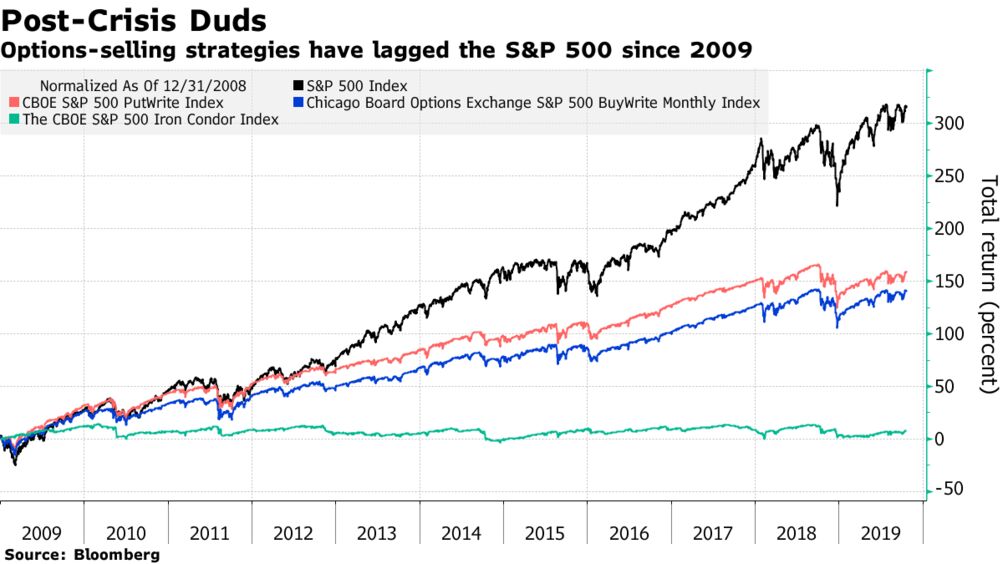

Derivative market stress abated in first 5 months of 2019, driving gains for short volatility investors — Huygens

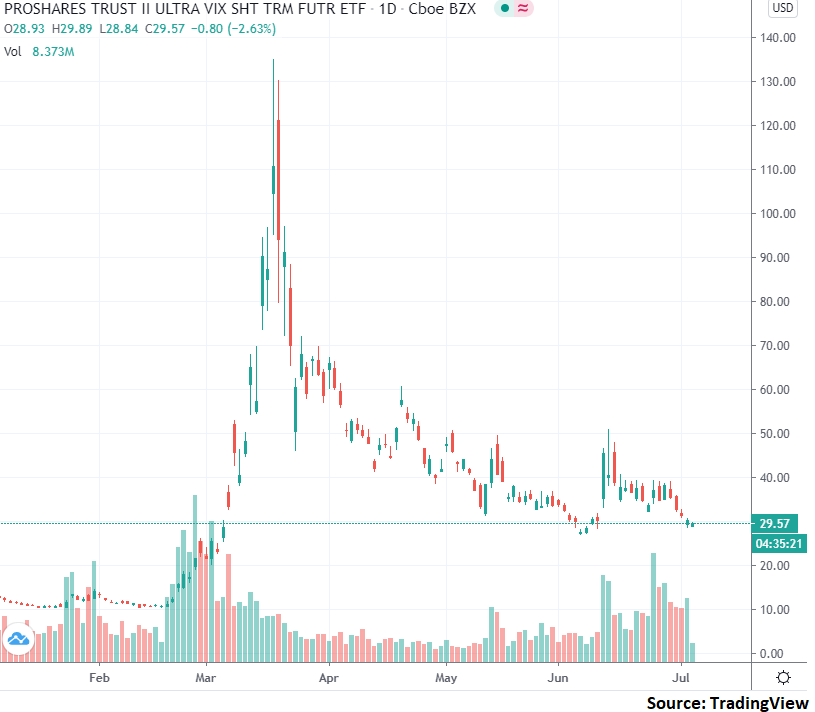

Expect a Volatile Future: Short-Volatility Funds Flooded With Cash - Mish Talk - Global Economic Trend Analysis

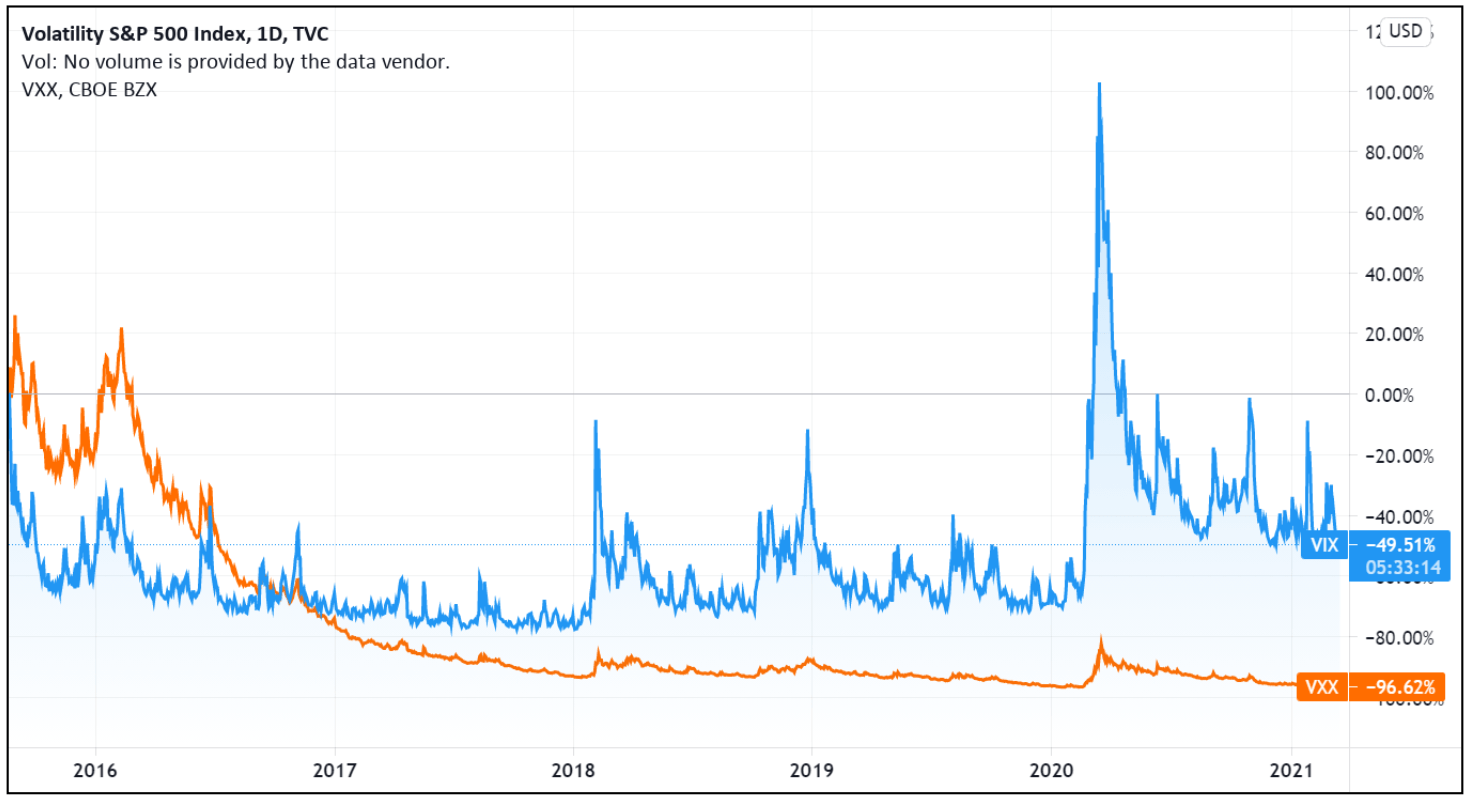

Lessons from the crash of short volatility ETPs | Artur Sepp Blog on Quantitative Investment Strategies